I have a pretty straight forward and logical approach to the buy vs. rent decision I’d like to share.

I’ll try to ignore the intangibles about home ownership, it’s stability, and security versus rentings flexibility and instability. These factors are nicely summarized by how long a person is looking to stay still for and calculated in the rent vs. buy calculator.

Lets continue with an assumption that any property that can be bought can likely be rented too, so we’re facing a choice.

Renters are often made of fun of for ‘paying someone else’s mortgage.’ By separating a purchase it is possible to determine just how much rent is paid to a mortgage and how much of a house price is for living and how much is for a investment.

At Current Interest Rates

Lets take a $400,000 Vancouver Condo alternatively rented at $1,500 per month. To help calculate the size of the investment, we’ll use the cost of capital. A common assumption for cost of capital is the prime rate plus 2%, and currently that is similar to the 5 year lending rate by banks so seems like a good number to use. Both are currently around 3%.

So that $400,000 home costs $12,000 a year in the cost of capital, or $1000 per month ($400,000*3%). A condo owner then adds strata fees and utilities and we can see that the buy versus rent calculation here is close to neutral at around $1500 per month, and the decision is likely best made on the intangibles, like stability versus flexibly and the time expected to stay in that location.

Now lets look at a $1M East side Vancouver Special and lets assume the owners live upstairs and rent out a basement suit. The cost of capital using the same calculation is $30,000, or $2,500 monthly. The downstairs renters kick in $1,000 and the upstairs would rent for $2,000 per month. In this scenario, the owners are ‘up’ $500 per month that goes to pay their property taxes, and again things are pretty much even.

The renter pays the owner and then the owner pays the bank. As both costs are comparable, the argument of paying someone else’s mortgage is actually only slightly true. The renter is actually paying the interest on someone’s mortgage, but not the principle, using these numbers at least.

Finally, lets look at $4M West Side Home. The cost of capital is $120,000 per year or $10,000 per month. Typical rent for these home is $5000 per month, so the owner pays the equivalent of $5000 per month plus property taxes to own the home if they rent to someone else, or $10,000 a month to live there.

At Long Term Average Interest Rates

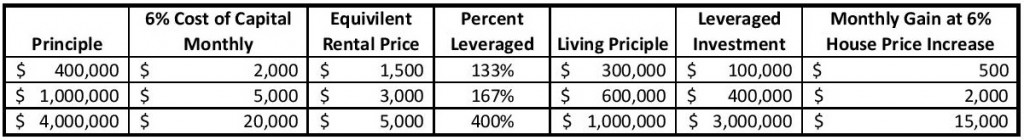

Now lets take a look at each of our 3 scenarios but at an interest rate or cost of capital at the long term average of 6%. I’ll also make an assumption that rents stay relatively steady, which I think is a fair assumption as it is a competitive market.

Looking at the final column, we can see that the condo owner pays $2,000 per month plus $500 in Strata for $2500 instead of $1500 in rent. The East Sider pays $5,000 per month instead of $3,000 in rent and the West Sider pays $20,000 per month instead of $5,000 in rent.

Why are all the home owners so excited about this proposition? I’ll argue it has less to do with stability and intangibles and far more to do with the opportunity to make a leveraged investment. The average person has very few opportunities in life to make leveraged investments of the types we hear about getting Wall Street fat cats rich. Banks simply don’t lend money to the average person like that. I know, when setting up Port Tack Charter no banks would touch it for a loan, and that was a business plan with low overheads and all of the start up money going into fairly liquid capital items.

But housing is different. Banks will lend for home mortgages and are encouraged to do so through the Bank of Canada’s insurance program. This industry gives the average person a chance to leverage themselves financially like no other opportunity does.

Returning to our Table of prices, lets look through them again with the lens of investment over the portion that can be justified by living. This time we’ll start with the long term rate of 6%.

Here we follow each housing option down the financial path. By comparing the cost of capital to rent, we can determine how leveraged each home owner is. By using this ratio to separate rent and investment, we calculate how much of the home can be justifiably called a ‘Living Principle,’ and how much should be considered a leveraged investment. Finally, by taking a growth rate in housing prices of 6% per year we see that everything balances out again and the prices of holding these investments can be justified.

But you see, we’re not living in average times, with 6% cost of capital and 6% housing price increases. We’re living in times where interest rates are at all time lows and housing prices are going up 10% per year… for now. Costs of owning are down, rates of price increases are up, who wouldn’t want to own a home?!!!

Who knows when… and nobody can predict the future, but there possibility of interest rates going up and housing prices levelling off seems likely.

I believe the above analysis shows that the only way to justify the current housing prices is to treat many of these homes as leveraged investments. The question we all need to be asking ourselves is if homes must go up in price to justify owning them, what happens when the growth stops? What prices can be justified by homes if there is no return through housing price growth? What I’ve labelled above the ‘Living Principle’ is a justifiable floor to prices… is there anything else?